how much tax is taken out of my paycheck in san francisco

FICA taxes consist of Social Security and Medicare taxes. The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15.

If I Get A Job In California That Pays 150k How Much Money Will I Get To My Account After Taxes Quora

For Tax Years 2017 and 2018 the North Carolina individual income tax rate is.

. Your average tax rate is. Normally 62 of an employees gross pay is taken out for this purpose and another 62 is paid by the employer. During the deferral period lasting through December 31.

If you make 70000 a year living in the region of California USA you will be taxed 15111. Your employer withholds a 62 Social Security tax and a. How much is payroll tax in PA.

Youll pay this state unemployment insurance tax on the first 7000 of each employees wages each yearup to 434 per employee in 2019. Only the very last 1475 you earned. California Income Tax Calculator 2021.

Your average tax rate is 1198 and your marginal. California unemployment insurance tax. Fast easy accurate payroll and tax so you can.

Calculate your California net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free California. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. So the tax year 2022 will start from July 01 2021 to June 30 2022.

That means that your net pay will be 43324 per year or 3610 per month. Customize using your filing status deductions exemptions and more. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

FICA taxes are commonly called the payroll tax. If you make 55000 a year living in the region of California USA you will be taxed 11676. Find out how much youll pay in California state income taxes given your annual income.

I would like the least amount of taxes taken out of my paycheck how to go about doing that. - Answered by a verified Tax Professional. The California bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

However they dont include all taxes related to payroll. Employers are required to withhold PA personal income tax at a flat rate of 307 percent of compensation. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Some states follow the federal tax year some. Calculating your California state income tax is similar to the steps we listed on our Federal paycheck calculator. The state tax year is also 12 months but it differs from state to state.

For a single filer the first 9875 you earn is taxed at 10. About Employer Withholding Taxes. Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries.

It can also be used to help fill steps 3 and 4 of a W-4 form. For Tax Years 2019 and 2020 the North Carolina individual income tax rate is 525 00525.

As Rideshare Prices Skyrocket Uber And Lyft Take A Bigger Piece Of Riders Payments Mission Local

How To Calculate Net Pay Step By Step Example

Tax Day 2022 Difficult Truths Revealed In California Calmatters

Calculating Federal Taxes And Take Home Pay Video Khan Academy

Michael Lane Al Twitter Because The Tax Rises Have Been So Gradual I Think Few People In Britain Have Stopped To Look At How It Compares With Other English Speaking Countries For

What S This S F Mandates Surcharge Doing On My Restaurant Check An Explainer

How Do State And Local Sales Taxes Work Tax Policy Center

In States With Property Tax On Cars Do I Also Have To Pay Sales Tax Mansion Global

2022 Federal State Payroll Tax Rates For Employers

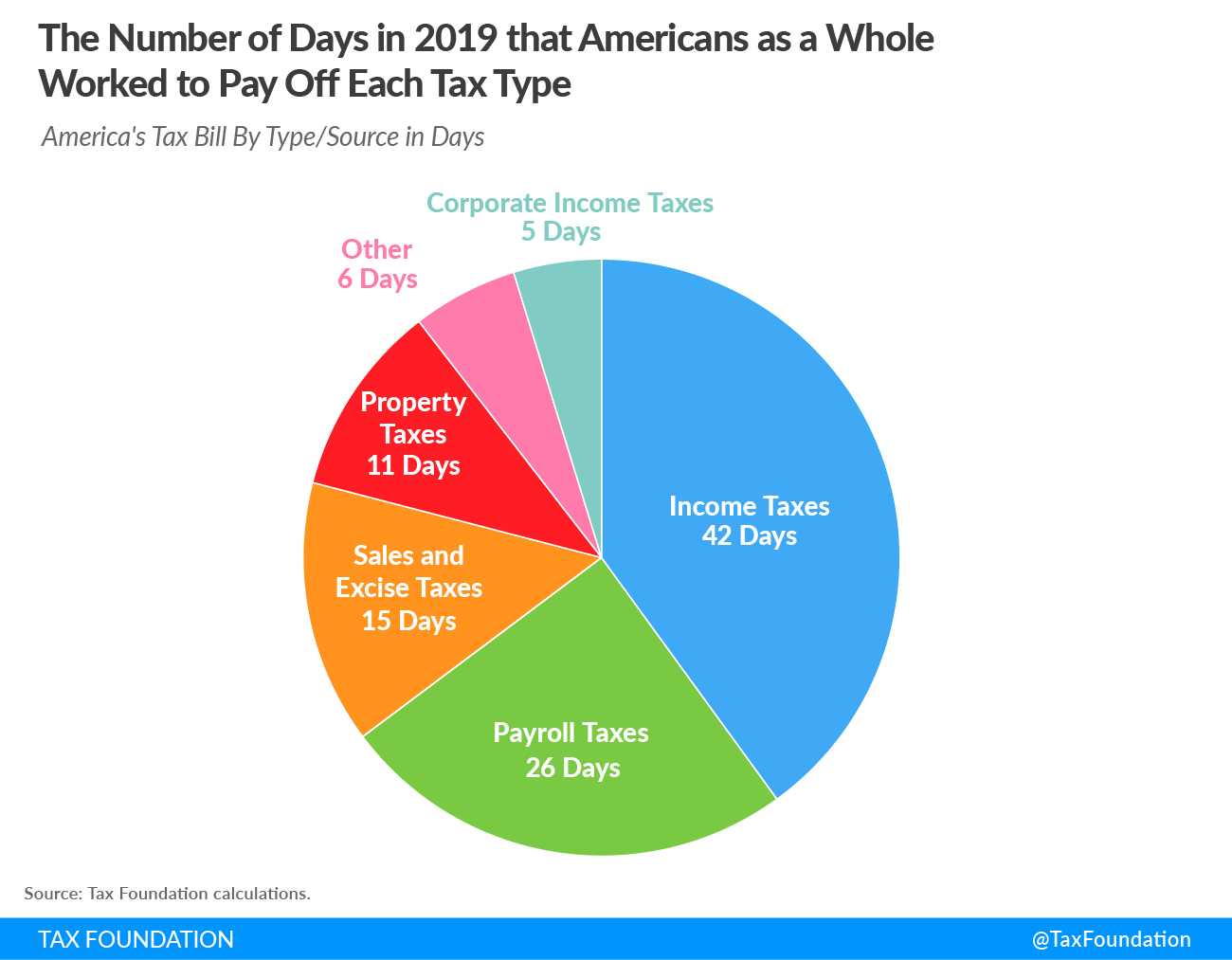

Tax Freedom Day Tax Foundation

The Average Salary In San Francisco Smartasset

How To Pay Little To No Taxes For The Rest Of Your Life

Bonus Tax Rate 2022 How Bonuses Are Taxed And Who Pays Nerdwallet

Raise My Taxes Now The Millionaires Who Want To Give It All Away The Super Rich The Guardian

1099 Tax Calculator How Much Will I Owe

How To Pay Little To No Taxes For The Rest Of Your Life

Income Tax Florida How Much You Could Save Wtsp Com

/buying-vs-renting-san-francisco-bay-area-ADD-V2-d0efaf2b7ac346bbba2c1ac389751ef1.jpg)

Buying Vs Renting In San Francisco What S The Difference

Pay Cut Google Employees Who Work From Home Could Lose Money Reuters